- Tweet

- Tweet

Take our nominees poll, and download a printable ballot here

Polls

completed:

Take our nominees poll, and download a printable ballot here

Polls

completed:

New government figures show that flu cases seem to be leveling off nationwide. Flu activity is declining in most regions although still rising in the West.

The Centers for Disease Control and Prevention says hospitalizations and deaths spiked again last week, especially among the elderly. The CDC says quick treatment with antiviral medicines is important, in particular for the very young or old. The season's first flu case resistant to treatment with Tamiflu was reported Friday.

Eight more children have died from the flu, bringing this season's total pediatric deaths to 37. About 100 children die in an average flu season.

There is still vaccine available although it may be hard to find. The CDC has a website that can help.

___

CDC: http://www.cdc.gov/flu/

MILAN (Reuters) - Italian bank Monte dei Paschi di Siena is seeking a financial investor to help revive the ailing lender and will remove a current cap on voting rights to help raise 1 billion euros ($1.3 billion), its chairman said.

"I would like to have a long-term financial investor," Alessandro Profumo told Italian business daily Il Sole 24 Ore in an interview published on Sunday. "Nationality is not a problem. The important thing is that it believes in our project".

Late on Saturday the Bank of Italy gave its approval to Monte Paschi's request for 3.9 billion euros ($5.3 billion) of state loans, which Profumo said would be issued by February.

The central bank's backing was the final stage required to free up the financial help for Italy's third-biggest lender, which this week revealed loss-making derivatives trades that could cost it about 720 million euros.

In October, investors cleared a 1 billion euro share issue as part of its business plan, which Profumo said would be launched by the end of 2015.

Shareholders in the world's oldest bank on Friday approved two additional capital boosting measures for a combined 6.5 billion euros to be used in case the bank is not able to pay back the loans and interest with cash.

Profumo said he was confident the bank would generate enough cash to pay back the state bailout over the next five years and may not need to turn to investors to raise the 6.5 billion euros, which he described "theoretical" guarantees.

"We believe in this. The objective is to return to profits already during the course of this year," he said.

The bank will remove its current 4 percent cap to voting rights before launching the 1 billion euro cash call, he added. The move would encourage investors who could end up with more than 4 percent stakes to participate.

The scandal around opaque Monte Paschi trades is widening fast and Italian media have reported that public prosecutors are investigating a large number of derivatives contracts.

The issue has shot to the centre of the campaign for next month's national election and has prompted questions about how the deals, which were conducted between 2006 and 2009 and involved Japanese bank Nomura and Deutsche Bank, could have been hidden from regulators.

Monte Paschi was already under investigation over its 9 billion euro cash acquisition of smaller lender Antonveneta from Spain's Santander in 2007.

In an interview with La Repubblica daily on Sunday, Monte Paschi Chief Executive Fabrizio Viola said he had no evidence at this time that any crime had been committed, but the bank would not hesitate to protect its interests by taking legal action should any crime be ascertained by judges. ($1 = 0.7421 euros)

(Reporting By Danilo Masoni; Editing by Alison Birrane and Jane Baird)

An intense fire ripped through a nightclub crowded with university students in southern Brazil early on Sunday morning, leaving behind a scene of horror with bodies piled in the club’s bathrooms and outside on the street.

At least 245 people were killed, police officials said.

As my colleague, Simon Romero reports, a flare from a live band’s pyrotechnic show ignited the fire in the nightclub, called Kiss, in the southern city of Santa Maria. Throughout the morning on Sunday, rescue workers hauled bodies from the still smoldering building.

One video posted to YouTube showed several bodies of apparently unconscious victims splayed on concrete outside of the club as medics check them for signs of life.

Shortly before the fire, a club D.J. posted a photo on Facebook from inside the crowded club with the caption: “Kiss is pumping.”

A short time later, another photo purportedly taken inside the club and widely disseminated through social media showed smoke billowing on the crowded dance floor.

BOATE KISS PEGANDO FOGO! http://t.co/tdV2DO4q

— Boatos SM ® #LUTO (@BoatoSM) 27 Jan 13

The fire quickly engulfed the building.

Firefighters, apparently joined by volunteers who shielded their faces with T-shirts, struggled to pull people from the burning building.

Photos from the scene showed frantic friends and family members gathered outside the club and the hospital.

What a difference just a few months makes. If you don’t recall, it was only last September when Apple’s (AAPL) share prices were blasting past $ 700 and bullish analysts were proclaiming that the company was well be on its way to having a $ 1 trillion valuation and dominating the tech industry for years to come. All that’s changed now as Apple has lost its spot as the world’s most valuable company and investors are panicking that the company’s growth rate may have peaked. This isn’t to say that Apple is doomed (and sorry, Apple haters, but it isn’t) or that it can’t return to the lofty heights it achieved last summer, but for the time being it no longer seems destined to mop the floor with its competitors for years to come.

[More from BGR: Unlocking your smartphone will be illegal starting next week]

This development is exciting in a sense because it’s been part of a fairly chaotic period for the mobile tech industry that has seen companies such as Samsung (005930) rise to become market leaders while longtime stalwarts such as RIM (RIMM) and Nokia (NOK) have seen their market shares plummet. Throughout the past several years, it seemed that the only constant in the mobile world was that Apple would continue to out-innovate its competitors by being the first to market with revolutionary smartphones and tablets that would turn the industry on its ear. Now that Apple’s incredible innovation machine shown signs of slowing, the question becomes, “What comes next?”

[More from BGR: Sony’s PS Vita: Dead again]

Those who look at the success of Samsung, Google (GOOG) and Amazon (AMZN) will naturally say that it’s Android’s time to pick up the slack. But even if you believe this, you have to ask yourself, “Whose version of Android?” While the open-source nature of Google’s mobile operating system has helped it spread quickly throughout the world, it’s also left Google with relatively little control over how manufacturers use its creation. Samsung, for instance, may have become enough of a powerhouse where it doesn’t need to rely on Android to sell smartphones and tablets anymore. If the company either ditches Android or creates its own heavily modified version of Android that doesn’t rely on Google apps such as Gmail, Maps and YouTube, where would that leave Google?

Google seems to know the danger that Samsung poses, which is why it’s reportedly working with its own Motorola division to create a so-called “X Phone” that it hopes will lessen Samsung’s dominance of the Android market, just as its own Nexus 7 tablet loosened the Amazon Kindle Fire’s grip of the low-cost Android tablet market. Google knows that Android is a massive money loser if people aren’t using it to get access to its web apps, and the company will do everything in its power to assure that Android remains Google-centric.

In the non-Android realm, we’ve seen some initial signs of life from Nokia after the company recently swung its first quarterly profit in a year and a half. While the company’s flagship Lumia 920 hasn’t exactly lit up the charts in the United States, it has produced some strong results in Europe and has at least bought the company some more time to improve on its recent gains. Similarly, there’s been a lot of positive buzz over the past couple of weeks for RIM (RIMM) and its upcoming BlackBerry 10 handsets. While RIM still faces a long, long road back from its 2012 near-death experience, the company is at least generating some hope among its diehard fans for the first time in many months.

Now, all of this exciting competition could be just a mirage if Apple blows the world away with the iPhone 5S, if Windows Phone 8 devices all bomb as Microsoft’s (MSFT) ill-fated Surface has, and if Samsung’s dominance forces rival Android vendors to quit the market. But for the first time in a while, I feel as though I don’t really know where the mobile industry is headed. And that is very exciting.

This article was originally published on BGR.com

Linux/Open Source News Headlines – Yahoo! News

01/25/2013 at 02:00 PM ET

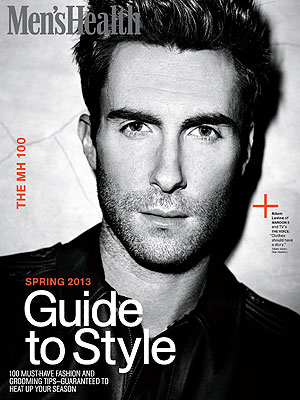

Courtesy Men’s Health

Courtesy Men’s Health

While some stars are repeat Fashion Faceoff offenders (we’re looking at you, Kim Kardashian), Adam Levine is determined to never be one of them. (Though the man really never should say never.)

In fact, his desire to have singular style is so strong that he won’t even pick up a plain old tee at a regular store for fear that another dude owns it. “I don’t want to buy a T-shirt and then go out to lunch and see someone else wearing the same thing,” Levine says in the new issue of Men’s Health. “I want my clothes to be unique. Not necessarily expensive, just one of a kind.”

So with that in mind, Levine puts a lot of thought into selecting those T-shirts. And even though they might look like basic Hanes to everyone else, what’s important to him is that he knows they’re not. The singer usually finds the tops at vintage shops because, “I also want them to have a story, a history, some meaning.”

In addition to his tees with history, the Maroon 5 frontman loves formalwear, saying, “[At] night I’ll throw on a suit and go out looking like a businessman.”

But it’s what he wears when he’s not on the red carpet or taping The Voice that really left us surprised — when he relaxes at home, Levine prefers something a bit, well, tighter. “I love waking up, throwing on some yoga pants, and hanging out all day looking like a psycho,” the singer reveals. His words, not ours.

For more Levine, pick up the March issue of Men’s Health, on newsstands Feb. 5. Tell us: Do you like Levine’s style? What do you think of guys wearing yoga pants?

Courtesy Men’s Health

Courtesy Men’s Health

–Jennifer Cress

PHOTOS: SEE MORE STAR STYLE IN ‘LAST NIGHT’S LOOK’

New government figures show that flu cases seem to be leveling off nationwide. Flu activity is declining in most regions although still rising in the West.

The Centers for Disease Control and Prevention says hospitalizations and deaths spiked again last week, especially among the elderly. The CDC says quick treatment with antiviral medicines is important, in particular for the very young or old. The season's first flu case resistant to treatment with Tamiflu was reported Friday.

Eight more children have died from the flu, bringing this season's total pediatric deaths to 37. About 100 children die in an average flu season.

There is still vaccine available although it may be hard to find. The CDC has a website that can help.

___

CDC: http://www.cdc.gov/flu/

NEW YORK (Reuters) - Stocks have been on a tear in January, moving major indexes within striking distance of all-time highs. The bearish case is a difficult one to make right now.

Earnings have exceeded expectations, the housing and labor markets have strengthened, lawmakers in Washington no longer seem to be the roadblock that they were for most of 2012, and money has returned to stock funds again.

The Standard & Poor's 500 Index <.spx> has gained 5.4 percent this year and closed above 1,500 - climbing to the spot where Wall Street strategists expected it to be by mid-year. The Dow Jones industrial average <.dji> is 2.2 percent away from all-time highs reached in October 2007. The Dow ended Friday's session at 13,895.98, its highest close since October 31, 2007.

The S&P has risen for four straight weeks and eight consecutive sessions, the longest streak of days since 2004. On Friday, the benchmark S&P 500 ended at 1,502.96 - its first close above 1,500 in more than five years.

"Once we break above a resistance level at 1,510, we dramatically increase the probability that we break the highs of 2007," said Walter Zimmermann, technical analyst at United-ICAP, in Jersey City, New Jersey. "That may be the start of a rise that could take equities near 1,800 within the next few years."

The most recent Reuters poll of Wall Street strategists estimated the benchmark index would rise to 1,550 by year-end, a target that is 3.1 percent away from current levels. That would put the S&P 500 a stone's throw from the index's all-time intraday high of 1,576.09 reached on October 11, 2007.

The new year has brought a sharp increase in flows into U.S. equity mutual funds, and that has helped stocks rack up four straight weeks of gains, with strength in big- and small-caps alike.

That's not to say there aren't concerns. Economic growth has been steady, but not as strong as many had hoped. The household unemployment rate remains high at 7.8 percent. And more than 75 percent of the stocks in the S&P 500 are above their 26-week highs, suggesting the buying has come too far, too fast.

MUTUAL FUND INVESTORS COME BACK

All 10 S&P 500 industry sectors are higher in 2013, in part because of new money flowing into equity funds. Investors in U.S.-based funds committed $3.66 billion to stock mutual funds in the latest week, the third straight week of big gains for the funds, data from Thomson Reuters' Lipper service showed on Thursday.

Energy shares <.5sp10> lead the way with a gain of 6.6 percent, followed by industrials <.5sp20>, up 6.3 percent. Telecom <.5sp50>, a defensive play that underperforms in periods of growth, is the weakest sector - up 0.1 percent for the year.

More than 350 stocks hit new highs on Friday alone on the New York Stock Exchange. The Dow Jones Transportation Average <.djt> recently climbed to an all-time high, with stocks in this sector and other economic bellwethers posting strong gains almost daily.

"If you peel back the onion a little bit, you start to look at companies like Precision Castparts

The gains have run across asset sizes as well. The S&P small-cap index <.spcy> has jumped 6.7 percent and the S&P mid-cap index <.mid> has shot up 7.5 percent so far this year.

Exchange-traded funds have seen year-to-date inflows of $15.6 billion, with fairly even flows across the small-, mid- and large-cap categories, according to Nicholas Colas, chief market strategist at the ConvergEx Group, in New York.

"Investors aren't really differentiating among asset sizes. They just want broad equity exposure," Colas said.

The market has shown resilience to weak news. On Thursday, the S&P 500 held steady despite a 12 percent slide in shares of Apple after the iPhone and iPad maker's results. The tech giant is heavily weighted in both the S&P 500 and Nasdaq 100 <.ndx> and in the past, its drop has suffocated stocks' broader gains.

JOBS DATA MAY TEST THE RALLY

In the last few days, the ratio of stocks hitting new highs versus those hitting new lows on a daily basis has started to diminish - a potential sign that the rally is narrowing to fewer names - and could be running out of gas.

Investors have also cited sentiment surveys that indicate high levels of bullishness among newsletter writers, a contrarian indicator, and momentum indicators are starting to also suggest the rally has perhaps come too far.

The market's resilience could be tested next week with Friday's release of the January non-farm payrolls report. About 155,000 jobs are seen being added in the month and the unemployment rate is expected to hold steady at 7.8 percent.

"Staying over 1,500 sends up a flag of profit taking," said Jerry Harris, president of asset management at Sterne Agee, in Birmingham, Alabama. "Since recent jobless claims have made us optimistic on payrolls, if that doesn't come through, it will be a real risk to the rally."

A number of marquee names will report earnings next week, including bellwether companies such as Caterpillar Inc

On a historic basis, valuations remain relatively low - the S&P 500's current price-to-earnings ratio sits at 15.66, which is just a tad above the historic level of 15.

Worries about the U.S. stock market's recent strength do not mean the market is in a bubble. Investors clearly don't feel that way at the moment.

"We're seeing more interest in equities overall, and a lot of flows from bonds into stocks," said Paul Zemsky, who helps oversee $445 billion as the New York-based head of asset allocation at ING Investment Management. "We've been increasing our exposure to risky assets."

For the week, the Dow climbed 1.8 percent, the S&P 500 rose 1.1 percent and the Nasdaq advanced 0.5 percent.

(Reporting by Ryan Vlastelica; Additional reporting by Chuck Mikolajczak; Editing by Jan Paschal)

Diario el Informador, via Reuters

A rescue worker assisted a man injured during a riot at the Uribana prison in Barquisimeto, a northwestern city in Venezuela.

CARACAS, Venezuela — Dozens of people have been killed in fierce clashes between inmates and National Guard soldiers at a Venezuelan prison, local news media accounts said Saturday.

It was the latest in a series of bloody riots over the past year in overcrowded prisons here, where guns and drugs abound and inmates control many aspects of prison life.

Newspapers reported that more than 50 people had been killed at the Uribana prison in Barquisimeto, a northwestern city, citing the director of a hospital where the wounded and the dead were taken. The reports said that more than 80 people had been injured.

The minister of prisons, Iris Varela, said the violence broke out Friday when National Guard troops entered the prison to conduct an inspection, with the aim of taking weapons away from prisoners and establishing order.

“There was a tragic situation of confusion that we lament very much,” Vice President Nicolás Maduro said on television early Saturday. Mr. Maduro spoke after returning to Venezuela from Cuba, where he had gone to visit the country’s ailing president, Hugo Chávez, who has been out of sight since undergoing surgery in Havana for cancer more than six weeks ago.

Mr. Maduro is running the country in Mr. Chávez’s absence.

He described the prison as one of the country’s most dangerous, and he promised an investigation. “The prisons must be governed by the law,” he said.

There were conflicting reports about the episode but it appeared that inmates had resisted efforts by the National Guard to enter areas of the prison. The local news media reports indicated that some of the inmate bosses, known as prans, had been killed in the raid. The reports said that most of the dead were prisoners.

Ms. Varela said that two days before the raid the authorities received information of an increase in violence inside the prison, involving a settling of scores between different factions vying for control.

At that point, she said, the decision was made to have the troops enter the prison.

But she said that word of the operation leaked out and that it was reported by a television station, Globovision, on the Web site of a local newspaper and on social networking sites.

She called the reports “a detonator of the violence” and blamed them for setting off the riot inside the prison.

Last August, 25 people were killed and dozens were wounded in gunfights between inmates battling for control of the Yare I prison south of Caracas, according the official reports.

Also last summer, 30 people were killed in a prison riot in Merida, in the Andes Mountains, according the Venezuela Prison Observatory, a nongovernmental watchdog group. Outside the prison on Saturday morning a few hundred people, including many anguished relatives of prisoners, waited for news. Some sang the national anthem and some held signs that said “We want peace” and “No more deaths.”

“This happens all the time and nothing changes,” said Yolanda Rodríguez, 57, who was waiting for information about her 24-year-old son, an inmate in the prison. “We know nothing about what’s happening inside.”

Girish Gupta contributed reporting from Barquisimeto, Venezuela.

Earlier this week, images that were purportedly of Samsung’s (005930) upcoming Galaxy Note 8.0 tablet leaked onto the Web. The slate looked like an oversized Galaxy S III smartphone and included the company’s physical home button, which had perviously been omitted from earlier Galaxy tablets. French blog Frandroid posted additional images of the tablet on Friday that confirmed it will include an S-Pen stylus, similar to the Galaxy Note II and Galaxy Note 10.1.

[More from BGR: Sony’s PS Vita: Dead again]

[More from BGR: The Boy Genius Report: Apple’s iMac takes desktop crown]

The Galaxy Note 8.0 is rumored to be equipped with a 1280 x 800 pixel resolution display, 1.6GHz quad-core processor and a 5-megapixel rear camera. The slate is also believed to include 2GB of RAM, 16GB of internal storage, a microSD slot and Android 4.2.

Samsung is expected to announce the Galaxy Note 8.0 tablet next month at Mobile World Congress in Barcelona.

This article was originally published on BGR.com

Wireless News Headlines – Yahoo! News

Copyright © News repugnant. All rights reserved.

Design  And Business Directories

And Business Directories